Does Renter's Insurance Cover Water Damage?

Water damage can be a scary term. While most people think of homes that are ruined by a leaky roof, there are many other things that can constitute water damage. Some of them are worse than others, but all of them need to be taken care of promptly, or you could experience more damage.

Call the Twin Home Experts today at (877) 713-6895 to receive a commitment-free inspection. We proudly service the Los Angeles County area.

What Counts as Water Damage?

Water damage is often confused with flooding which is what happens when outside water comes inside. Flooding is when water enters your residence from an overflowing river or pond. You may also experience flooding during heavy rain because the water often doesn’t have anywhere to go!

Water damage is different. It happens when water comes inside the dwelling, without hitting the ground. This can be caused by many different sources including:

- A leaky roof that causes damage every time it rains

- A leaky faucet and busted pipes that lead to extra moisture and water

- A faulty sump pump can also bring extra water instead of removing it

- Overflowing sinks can cause water damage to the areas around the sink.

Call the Twin Home Experts today at 1-877-713-6895 to receive a commitment free inspection. We proudly service the Los Angeles County.

Will My Renter's Insurance Cover Water Damage?

If you aren’t a homeowner, you may still be responsible for some of the damages. For this reason, you may want to have renter’s insurance. However, it may not cover everything.

Renter’s insurance will only cover personal property – your own items that were damaged due to water damage.

Your renter’s insurance will not cover any expenses that occur due to the water damage. Your landlord is required to have insurance to cover the cost of maintaining the building. He or she will be responsible for fixing any pipes or the leaky roof and cleaning up the mess afterward.

Most homeowners and landlords need to have separate flood insurance if the building is in a flood zone. Their home owner’s insurance won’t even cover the damages.

Because every policy is different, it is important that you know exactly what is covered when you buy your policy. You really need to read the fine print to understand what you will be held liable for, in case there is water damage to your apartment or the home that you are renting.

How to Prevent Water Damage

The scary thing about water damage is that you often don’t see the full damage right away. Water lying in an area can create problems with the floor, the ceiling under it, and everything in between. A leaky pipe can ruin walls, floors, and ceilings.

Because of this, you need to watch your home and apartment carefully. Anytime you notice a problem, you need to contact your landlord right away. Leaky faucets, pipes, and roofs need to be dealt with right away before the problem worsens and becomes more expensive to fix.

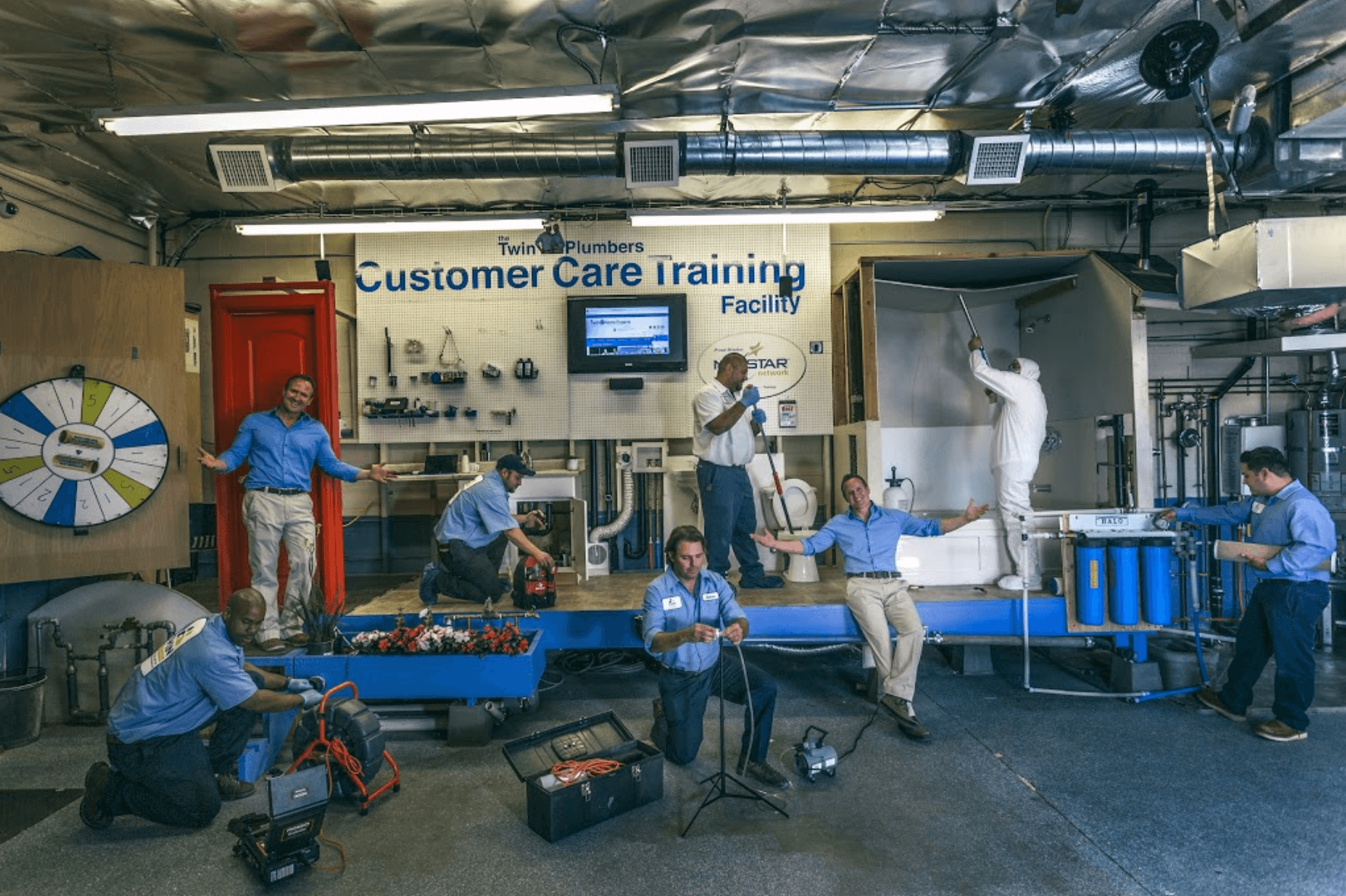

How Can Twin Home Experts Help?

As a responsible tenant, you always want your landlord to know if something is wrong with your rented space. If your residence experiences water damage, you can refer your property manager to Twin Home Experts for help. We offer free assessments in the Los Angeles area.

Twin Home Experts has been in business for over thirty years and has completed more than two hundred thousand jobs, helping families with all of their plumbing, water, and mold needs.

A SAFE AND CLEAN HOME

Is One Click Away

Let’s get started on your project! Contact our team online or give us a call at (877) 978-1805.